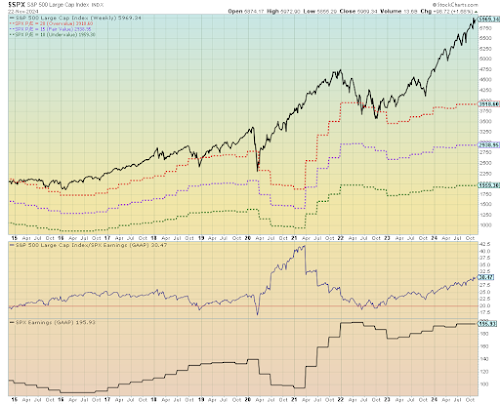

Standard & Poor's 500 Valuation: Where Does the Market Stand Right Now?

Investors should develop the habit of assessing whether the current market valuation is overvalued, fairly valued, or undervalued when investing their hard-earned capital in the stock market. When a market valuation is considered overvalued, it does not necessarily suggest an imminent collapse. Similarly, when a broad market is considered undervalued, it does not guarantee an immediate bottom. However, this valuation indicator can provide investors a big picture of the risk-reward ratio of the market they are considering investing in. Understanding stock market valuation is similar to understanding the real estate market. Knowing whether housing market prices are fair, overpriced, or underpriced can drastically affect your investment decisions and returns. When the market is fairly valued, it’s like buying a house at its appraised value - you’re making a reasonable investment with no overpayment, and there is potential for moderate returns if cond...