Timeless Wisdom: Core Principles from "The Intelligent Investor" Book

Experienced investors understand that achieving lasting success over the long term—whether 10, 20, 30 years, or more—is never an easy feat. Each day, many “investment” ideas circulate, with individuals often chasing one after another, hoping for overnight success. However, most fail to achieve this goal. Some may get lucky and achieve short-term success, only to lose their gains afterward. Others might have a brief moment in the spotlight, like a pop star who rises to fame overnight, only to quickly fade away.

Why is long-term success in investing so elusive? Perhaps because many popular investment ideas lack sound principles from the outset.

What constitutes a sound investment principle? It’s a philosophy that has stood the test of time and remains robust today. In this blog, we’d like to share a few core principles from this book, hoping they will benefit you and help you to build the right mindset, proper expectations, and a strong foundation to become a successful investor.

#1: "A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price."

A stock is more than a ticker symbol or a price on a screen; it represents an ownership stake in a real business with tangible assets, operations, and growth potential. When purchasing a stock, one is not merely buying a position in the market but rather investing in a company’s future and its capacity to create value. This means that a stock purchase should only come after a careful evaluation of the business’s financial health, competitive strengths, and the durability of its market advantage. Wise investors seek companies with a unique edge over competitors and with strategies to sustain that edge for a decade or more, focusing on the long-term potential of the business rather than the daily fluctuations in its stock price.

#2: "The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The intelligent investor is a realist who sells to optimists and buys from pessimists."

Emotional cycles can drive stock market prices beyond their true value. Market sentiment often swings between extremes, where optimism pushes prices too high, and pessimism drags them too low. For investors, understanding this dynamic is crucial: it enables them to make rational decisions rather than getting swept up in the crowd’s emotional reactions. By recognizing these market swings, intelligent investors can act strategically—selling when prices are inflated by optimism and buying when prices are deflated by fear. This disciplined approach not only helps manage risk but also takes advantage of the market’s natural fluctuations to achieve better returns.

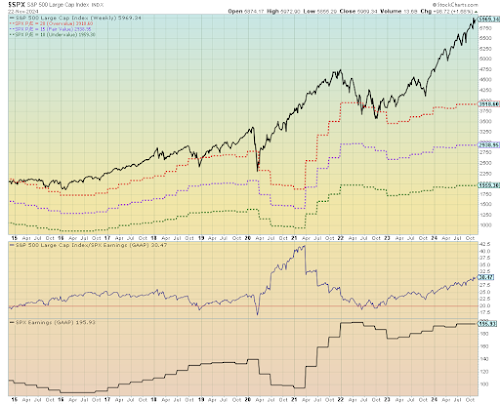

#3: "The future value of every investment is a function of its present price. The higher the price you pay, the lower your return will be."

The price you pay today sets the stage for your future returns. When you buy a stock at a high price, your potential returns diminish, while buying at a fair or undervalued price improves your upside. Therefore, learning to evaluate a business’s fair value is an essential skill for any investor. By understanding a company’s fundamentals, growth potential, and competitive position, an investor can better determine if the stock’s current price reflects its true worth. This skill helps investors avoid overpaying for hype and identify opportunities where quality businesses are selling at their fair value, setting the foundation for solid long-term returns.

#4: "No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong. Only by insisting on what Graham called the “margin of safety”—never overpaying, no matter how exciting an investment seems to be—can you minimize your odds of error."

There is always a risk of being wrong, no matter how thorough the analysis. Recognizing this, Benjamin Graham’s concept of a “margin of safety” becomes essential. By buying investments at a discount to their intrinsic value, investors create a buffer against unexpected downturns or misjudgments. This approach minimizes the impact of potential errors and protects the investor’s capital, even if the investment doesn’t perform as expected.

Note in today’s U.S. market, finding investments at a significant discount to their intrinsic value has become increasingly challenging. With a wealth of information and sophisticated analysis tools at their disposal, market players are more informed and adept, making mispriced opportunities rarer than in the past. However, the core principle remains as important as ever: disciplined investors must resist the temptation to overpay, no matter how appealing an investment appears. Staying grounded in valuation fundamentals and adhering to this principle helps investors avoid excessive risks and maintain a strong foundation for long-term success, even in a competitive and efficient market.

#5: "The secret to your financial success is inside yourself. If you become a critical thinker who takes no Wall Street “fact” on faith, and you invest with patient confidence, you can take steady advantage of even the worst bear markets. By developing your discipline and courage, you can refuse to let other people’s mood swings govern your financial destiny. In the end, how your investments behave is much less important than how you behave."

Patience and discipline are fundamental to achieving lasting success in stock market investing. With patience, an investor can ride out market downturns and even take advantage of bear markets. Discipline helps prevent emotional decisions influenced by others’ fears or excitement. Ultimately, how you behave—staying calm, patient, and disciplined—matters far more than how your investments behave in the short term.

To close, here’s a powerful endorsement from Warren Buffett, praising the extraordinary framework this book provides:

"It is rare that the founder of a discipline does not find his work eclipsed in rather short order by successors. But over forty years after publication of the book that brought structure and logic to a disorderly and confused activity, it is difficult to think of possible candidates for even the runner-up position in the field of security analysis."

References

Benjamin Graham: The Intelligent Investor, revised edition

Comments

Post a Comment